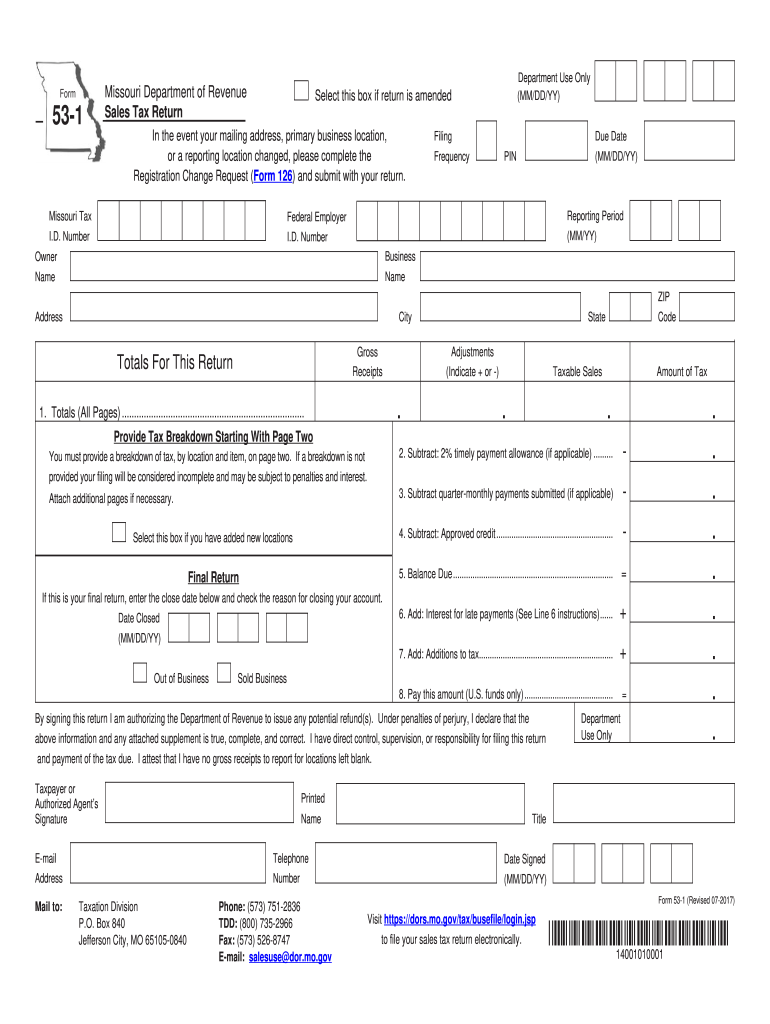

Missouri Income Tax 2025 - Missouri Tax Forms 2025 Myra Tallia, For all tax years beginning on or after january 1, 2025, the missouri adjusted gross income limitation based on filing status will be removed when. Calculate your annual take home pay in 2025 (that’s your 2025 annual salary after tax), with the annual missouri salary calculator. Form 53 1 Fill out & sign online DocHub, Missouri's 2025 income tax ranges from 2% to 5%. Learn about some tax planning strategies to reduce your missouri income taxes.

Missouri Tax Forms 2025 Myra Tallia, For all tax years beginning on or after january 1, 2025, the missouri adjusted gross income limitation based on filing status will be removed when. Calculate your annual take home pay in 2025 (that’s your 2025 annual salary after tax), with the annual missouri salary calculator.

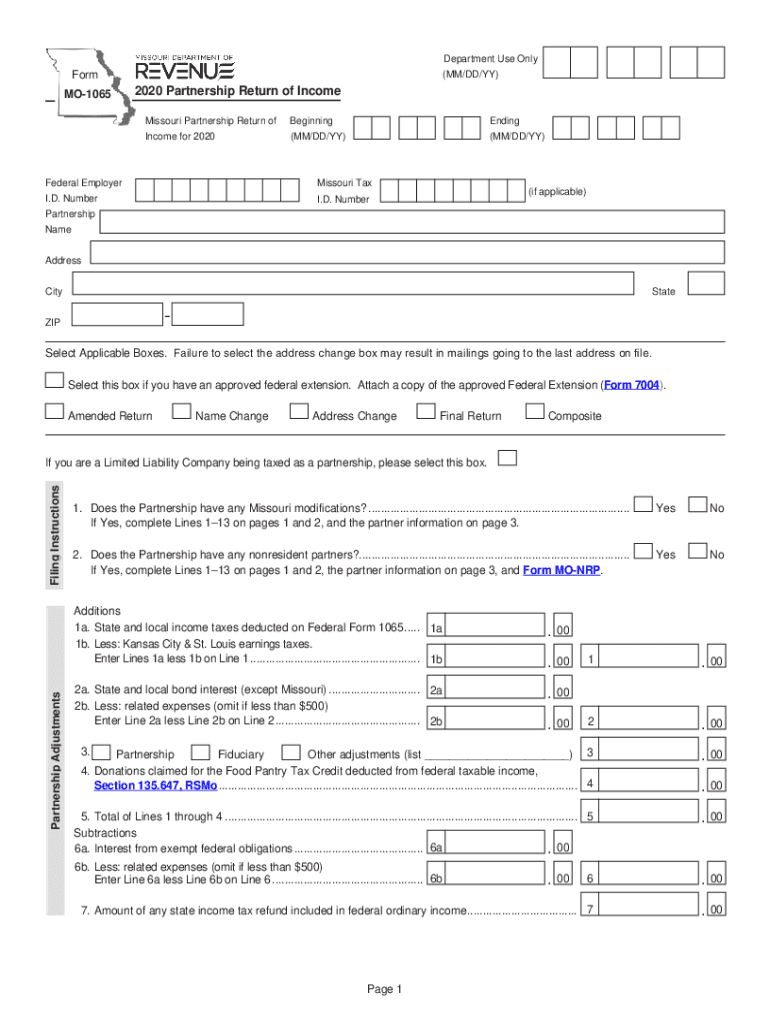

Mo 1065 Instructions 20252025 Form Fill Out and Sign Printable PDF, Calculate your missouri state income taxes. Your missouri state income tax is determined by your income and filing status, and it is subject to a progressive tax rate that ranges from 0% to 5.4%.

The missouri department of revenue (dor) released individual income tax year 2025 pension frequently asked questions (faqs).

Enter the taxable income from your tax form and we will calculate your tax for you.

17.506k Salary After Tax in Missouri US Tax 2025, Missouri department of revenue, find information about motor vehicle and driver licensing services and taxation and collection services for the state of missouri. This new legislation will repeal all currently scheduled rate reductions as of january 2023.

This online filing method is available for use by taxpayers who:.

Missouri State Tax 2023 2025, In alphabetical order, these states are: Missouri department of revenue, find information about motor vehicle and driver licensing services and taxation and collection services for the state of missouri.

54.647k Salary After Tax in Missouri US Tax 2025, The missouri department of revenue (dor) released individual income tax year 2025 pension frequently asked questions (faqs). Discover the missouri income tax and its rates in 2025.

Missouri Income Tax 2025. Updated on apr 24 2025. This page has the latest missouri brackets and tax rates, plus a missouri income tax calculator.

2025 Missouri State Tax Calculator for 2025 tax return, Your missouri state income tax is determined by your income and filing status, and it is subject to a progressive tax rate that ranges from 0% to 5.4%. This page has the latest missouri brackets and tax rates, plus a missouri income tax calculator.

Under protest and/or filing an appeal. The free online 2025 income tax calculator for missouri.